<iframe> API messages

All messages sent to and from the LoanPASS app are plain JavaScript objects, with a message field indicating the type of message. Note that we may add more messages in the future, so to future-proof your integration, ensure unknown message types are ignored!

Sendable messages

These are messages that can be sent to loanpass from the host application.

connect

Connect to the LoanPASS <iframe> API. This message must be sent to the LoanPASS app before any other messages, and this message must be sent before any messages will be sent from LoanPASS back to your app.

After sending connect, the <iframe> will respond with the listening message once it's ready to receive more messages.

It's recommended that this message is sent in an event listener that listens for the <iframe>'s load event.

Fields

None

Example

iframe.addEventListener("load", function () {

iframe.contentWindow.postMessage(

{

message: "connect",

},

loanpassOrigin

);

});

create-pipeline-record

Creates a new pipeline record using the current state on the "Price a Loan" page including field values, selected product, and selected rate/lock period.

Fields

pipelineFieldValues: An array of pipeline-only fields to set and their values. The format matches the.creditApplicationFields[]schema from the/execute-productand/execute-summaryPublic API endpoints, and the fields are defined in the "Pipeline Settings" tab of the "Fields" page.

Example

iframe.contentWindow.postMessage(

{

message: "create-pipeline-record",

pipelineFieldValues: [

{

fieldId: "field@borrower-last-name",

value: {

type: "string",

value: "Smith",

},

},

{

fieldId: "field@loan-number",

value: {

type: "string",

value: "12345",

},

},

],

},

loanpassOrigin

);

enable-float-requests

Set a flag to allow the "Float Request" button to send float requests back to the parent application.

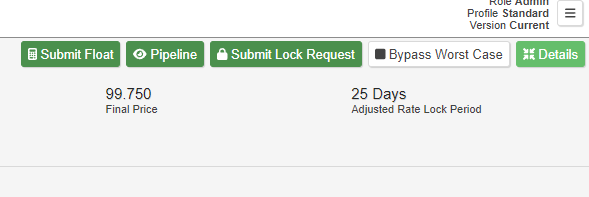

When viewing a pipeline record on the "Price a Loan" page, the user is presented with a "Submit Float" button. Before sending the enable-float-requests message, the "Submit Float" button will only create a new pipeline scenario for the selected pipeline record. After sending the enable-float-requests message, the "Submit Float" button will both create a new pipeline scenario as well as post a float-request message back to the parent application.

Example

iframe.contentWindow.postMessage(

{

message: "enable-float-requests",

},

loanpassOrigin

);

enable-price-locking

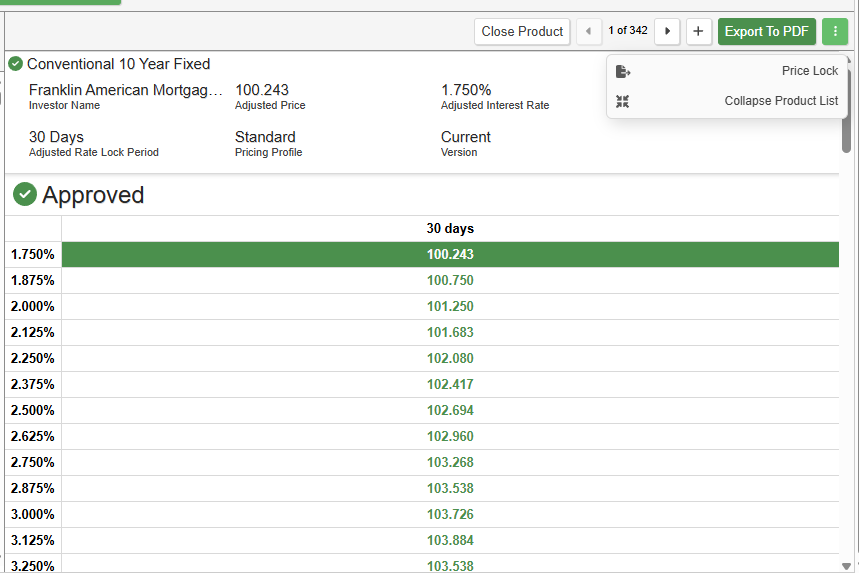

A legacy message used to set a flag that shows a "Lock Request" button in the UI. When clicked, the LoanPASS app will send a price-lock message containing loan information back to your app. This button does not record a lock in the ledger in the way that the normal lock request buttons will. Sending enable-price-lock doesn't itself handle price locking, it just enables integrators to grab the pricing data to handle price locking through another system.

The label of the button can be changed by setting the lockRequestLabel field on the message.

After this message is sent and after filling out the fields on the "Price a Loan" page, clicking into a product, then clicking one of the prices in the table, the 3 dot menu will display a button with the chosen label that when clicked will send a price-lock message back to the host application.

Fields

lockRequestLabel(optional): A string indicating what label to use for the price locking button. Defaults to "Lock Request". The same label will also be used after clicking the button, where the label will change to say "${lockRequestLabel} Sent".

Example

iframe.contentWindow.postMessage(

{

message: "enable-price-locking",

lockRequestLabel: "Lock Request", // optional

},

loanpassOrigin

);

log-in

Automatically log the user in to LoanPASS with the given credentials.

NOTE: If the user is already signed in to the LoanPASS UI, then this message may cause them to log out and be logged in with the specified credentials. When this happens, the <iframe> may be reloaded. To account for this properly, you should wait for the listening message again before sending any more messages.

SECURITY NOTE: Like all messages, the log-in message is handled entirely client-side, so the given email and password will be sent to the server in exactly the same way as if the user had entered the email and password themselves. However, for security purposes, that leads to 2 details to consider:

- The end user can get the credentials. A tech-savvy user could trivially use the Web Inspector in their browser to find the email and password that were sent to the

<iframe>(say, by viewing the "Network" tab and looking for the "log in" API call). - The credentials should be stored and sent securely. The password for the user should be considered a secret, so it should be treated as such and standard best practices should be used.

Fields

clientAccessId: The client access ID to log in as. This should be the same as the client access ID used to embed the<iframe>.emailAddress: The email address of the account to sign in as.password: The password of the account to sign in as.

Example

Signing in a user

iframe.contentWindow.postMessage(

{

message: "log-in",

clientAccessId: "example-client",

emailAddress: "user@example.com",

password: "password1234",

},

loanpassOrigin

);

Signing in a user on page load

// Track the current state of the user:

// 1. "pending": iframe just added to page, user may be logged out or logged in

// 2. "logged-in": `log-in` message sent, user is now logged in

let userState = "pending"; // "pending" | "logged-in"

const loanpassOrigin = "https://app.loanpass.io";

const clientAccessId = "example-client";

const emailAddress = "user@example.com";

const password = "password1234";

window.addEventListener("load", function () {

console.log("page loaded");

const iframe = document.createElement("iframe");

const handleListening = () => {

switch (userState) {

case "pending":

console.log("sending log in message...");

iframe.contentWindow.postMessage(

{

message: "log-in",

clientAccessId,

emailAddress,

password,

},

loanpassOrigin

);

userState = "logged-in";

break;

case "logged-in":

console.log("log in completed");

break;

}

};

window.addEventListener("message", function (event) {

if (event.origin !== loanpassOrigin) {

console.warn("received message from unexpected origin", event);

return;

}

console.log("received message", event.data);

switch (event.data.message) {

case "listening":

handleListening();

break;

}

});

iframe.src = `${loanpassOrigin}/frame-redirect/${clientAccessId}`;

iframe.addEventListener("load", function () {

console.log("iframe load event fired");

if (iframe.contentWindow == null) {

return;

}

console.log("connecting...");

iframe.contentWindow.postMessage(

{

message: "connect",

},

loanpassOrigin

);

});

document.getElementById("iframe-container").appendChild(iframe);

});

log-out

Log out the current user if they are logged in.

NOTE: Sending this message may trigger the <iframe> to reload! To continue receiving messages after sending the log-out message, make sure the connect message is sent after the load event triggers on the <iframe>. See the connect message for more details.

Fields

clientAccessId: The client access ID of the login page to show.

Example

iframe.contentWindow.postMessage(

{

message: "log-out",

clientAccessId: "example-client",

},

loanpassOrigin

);

See log-in for more details about logging the user back in after logging out.

set-fields

Fill in fields on the "Price a Loan" page with preset values.

Fields

Fill in fields on the "Price a Loan" page with preset values. Calling set-fields is very similar to loading an existing scenario, except the data is controlled by the integration rather than the LoanPASS backend.

Fields

fields: An array of specifying fields to set and their values. The format matches the.creditApplicationFields[]schema from the/execute-productand/execute-summaryPublic API endpoints.fieldId: The field ID.value: An object describing the value of the field, with atypefield indicating the type of value.

Example

iframe.contentWindow.postMessage(

{

message: "set-fields",

fields: [

{

fieldId: "field@occupancy-type",

value: {

type: "enum",

enumTypeId: "occupancy-type",

variantId: "primary-residence",

},

},

{

fieldId: "field@desired-loan-term",

value: {

type: "duration",

unit: "months",

count: "6",

},

},

{

fieldId: "field@number-of-units",

value: {

type: "number",

value: "1",

},

},

],

},

loanpassOrigin

);

set-pipeline-record-id

Loads an existing pipeline record on the "Price a Loan" page. You may choose to pass an optional list of field values to overwrite the values loaded by the pipeline record.

Fields

pipelineRecordId: The ID of the pipeline record you want to load.overrideCreditApplicationFields: An optional array of fields to set and their values. The format matches the.creditApplicationFields[]schema from the/execute-productand/execute-summaryPublic API endpoints. If left empty the pipeline record will use the values stored within itself. If desired, passing a null value with afieldIdwill clear out that input from the loaded field values.

Examples

- Loading a Record

iframe.contentWindow.postMessage(

{

message: "set-pipeline-record-id",

pipelineRecordId: "51",

// This will retain the field values saved in the pipeline record

overrideCreditApplicationFields: [],

},

loanpassOrigin

);

- Overriding Fields

iframe.contentWindow.postMessage(

{

message: "set-pipeline-record-id",

pipelineRecordId: "51",

// This will override fields stored in the pipeline record

overrideCreditApplicationFields: [

{

fieldId: "field@occupancy-type",

value: {

type: "enum",

enumTypeId: "occupancy-type",

variantId: "primary-residence",

},

},

{

fieldId: "field@desired-loan-term",

value: {

type: "duration",

unit: "months",

count: "6",

},

},

{

fieldId: "field@number-of-units",

value: {

type: "number",

value: "1",

},

},

],

},

loanpassOrigin

);

- Clearing out fields using a

nullvalue

iframe.contentWindow.postMessage(

{

message: "set-pipeline-record-id",

pipelineRecordId: "51",

// This will override fields stored in the pipeline record by clearing the

// value if it exists. Note that the entire outer `value` property is where

// null should be passed

overrideCreditApplicationFields: [

{

fieldId: "field@occupancy-type",

value: null,

},

{

fieldId: "field@desired-loan-term",

value: null,

},

{

fieldId: "field@number-of-units",

value: null,

},

],

},

loanpassOrigin

);

set-version

Tell the <iframe> which version the host integration is using.

Fields

version: A version string.

Example

iframe.contentWindow.postMessage(

{

message: "set-version",

version: "1",

},

loanpassOrigin

);

Loading the most current version

iframe.contentWindow.postMessage(

{

message: "set-version",

version: "current",

},

loanpassOrigin

);

Receivable messages

These are messages that LoanPASS can send back to the host application.

enable-float-requests-error

Sent if enable-float-requests could not be applied.

Fields

error: An error message.

Example

{

"message": "enable-float-requests-error",

"error": "Failed to float requests. Please contact your system administrator for assistance."

}

enable-price-locking-error

Sent if enable-price-locking could not be applied.

Fields

error: An error message.

Example

{

"message": "enable-price-locking-error",

"error": "Failed to enable price locking. Please contact your system administrator for assistance."

}

float-request

Sent when a user clicks the "Submit Float" button in the UI after the enable-float-requests message is sent. The shape of this message is the same as the price-lock message.

Fields

role: Contains details about the user's active role.id: The role ID.nameThe display name of the role.

pricingProfile: Contains details about the user's active pricing profile.id: The pricing profile ID.nameThe display name of the pricing profile.

product: Contains details about the product that was price locked.id: The product ID.nameThe display name of the product.

investor: Contains details about the investor of the product that was price locked.id: The investor's ID.name: The display name of the investor.

scenario: The details about the price scenario that was locked. The schema matches the.priceScenarios[]schema returned from the/execute-productPublic API endpoint.status: The status of the price scenario, such asapproved,rejected, etc.adjustedRate: The rate with rate adjustments applied.adjustedPriceThe price with price adjustments applied.priceScenarioFields: An array of price scenario fields and values.fieldId: The field ID.value: An object describing the value of the field, ornullif the field has no value.

calculatedFields: An array of calculated fields and their values for this price scenario.fieldId: The calculated field ID.value: An object describing the value of the field, ornullif the field has no value.

creditApplicationFields: An array of fields and their values that were filled in by the user for the price scenario. This corresponds to thecreditApplicationFieldsfield for the/execute-productPublic API endpoint.fieldId: The input's field ID.value: An object describing the value of the field.

Example

{

"message": "float-request",

"role": {

"id": "11",

"name": "Loan Officer"

},

"pricingProfile": {

"id": "22",

"name": "Standard"

},

"investor": {

"id": "123",

"name": "Test Investor",

"code": "TI",

"isPricingEnabled": true

},

"product": {

"id": "1234",

"code": "EXAMPLE",

"name": "Example Product",

"description": "Example product",

"activationTimestamp": "2021-01-01T00:00:00Z",

"deactivationTimestamp": null,

"investorId": "123"

},

"scenario": {

"id": "00000000-0000-0000-0000-000000000000",

"priceScenarioFields": [

{

"fieldId": "base-interest-rate",

"value": {

"type": "number",

"value": "1.0"

}

},

{

"fieldId": "rate-lock-period",

"value": {

"type": "duration",

"count": "15",

"unit": "days"

}

},

{

"fieldId": "base-price",

"value": {

"type": "number",

"value": "101.000"

}

}

],

"calculatedFields": [

{

"fieldId": "calc@fsb-lpmi-refinance",

"value": {

"type": "number",

"value": "0.000"

}

},

{

"fieldId": "calc@fsb-jumbo-max-price",

"value": null

},

{

"fieldId": "calc-field@ah-va-purch-tier",

"value": {

"type": "number",

"value": "4"

}

}

],

"adjustedRate": "1.75",

"adjustedRateLockPeriod": {

"count": "15",

"unit": "days"

},

"adjustedPrice": "101.000",

"status": "approved",

"priceAdjustments": [

{

"ruleId": "1234",

"amount": "0.25",

"description": "Price adjustment 1"

},

{

"ruleId": "5678",

"amount": "0.25",

"description": "Price adjustment 2"

}

],

"marginAdjustments": [

{

"ruleId": "12345",

"amount": "-0.300",

"description": "Margin adjustment"

}

],

"rateAdjustments": [],

"stipulations": []

},

"creditApplicationFields": [

{

"fieldId": "field@occupancy-type",

"value": {

"type": "enum",

"enumTypeId": "occupancy-type",

"variantId": "primary-residence"

}

},

{

"fieldId": "field@loan-purpose",

"value": {

"type": "enum",

"enumTypeId": "loan-purpose",

"variantId": "purchase"

}

},

{

"fieldId": "field@decision-credit-score",

"value": {

"type": "number",

"value": "750"

}

},

{

"fieldId": "field@state",

"value": {

"type": "string",

"format": "us-state-code",

"value": "TX"

}

},

{

"fieldId": "field@property-type",

"value": {

"type": "enum",

"enumTypeId": "property-type",

"variantId": "single-family"

}

},

{

"fieldId": "field@base-loan-amount",

"value": {

"type": "number",

"value": "400000.00"

}

}

]

}

float-request-error

Sent if a float-request could not be fulfilled.

Fields

error: An error message.

Example

{

"message": "float-request-error",

"error": "Failed to submit float request from iframe message. Please contact your system administrator for assistance."

}

float-requests-enabled

Confirmation that float requests have been enabled after sending enable-float-requests.

Fields

None

Example

{ "message": "float-requests-enabled" }

listening

Sent after the <iframe> receives the connect message and is ready to receive more messages.

Fields

None

Example

{ "message": "listening" }

lock-ledger-update-error

Sent if LoanPASS failed to update the lock ledger.

Fields

error: An error message.

Example

{

"message": "lock-ledger-update-error",

"error": "Can't submit lock request when pricing is disabled."

}

lock-ledger-updated

Sent when a lock ledger update occurs for the active pipeline record.

Fields

pipelineRecord: The current pipeline record object.lockLedgerEntries: An array of lock ledger entry objects for this record.

Example

{

"message": "lock-ledger-updated",

"pipelineRecord": {

"id": "1",

"ownerId": "5",

"createdAt": "2023-10-12T18:23:06.843820Z",

"updatedAt": "2024-08-22T15:59:42.929269Z",

"status": "open",

"lockState": {

"lockStatus": {

"kind": "unlocked"

},

"lastActionTaken": null,

"lastLockDeniedDate": null,

"lastExpirationDate": null,

"actionHistory": []

},

"pricingProfileId": "2",

"pipelineOnlyFieldValues": [

{

"fieldId": "field@borrower-last-name",

"value": {

"type": "string",

"value": "Jones"

}

}

],

"pricingNotificationFieldValues": [],

"preferredScenario": {

"pipelineRecordId": "1",

"id": "1",

"pricingProfileId": null,

"name": "Initial Inputs",

"createdAt": "2023-10-12T18:23:06.843820Z",

"preferred": true,

"creditApplicationFieldValues": [

{

"fieldId": "field@occupancy-type",

"value": {

"type": "enum",

"enumTypeId": "occupancy-type",

"variantId": "primary-residence"

}

},

{

"fieldId": "field@purchase-price",

"value": {

"type": "number",

"value": "800000.00"

}

},

{

"fieldId": "field@loan-purpose",

"value": {

"type": "enum",

"enumTypeId": "loan-purpose",

"variantId": "purchase"

}

}

],

"selectedProductId": "2120",

"selectedPriceScenarioInfo": {

"type": "rate-with-lock-period",

"selectedInterestRate": "2.5",

"selectedLockPeriod": {

"count": "30",

"unit": "days"

}

},

"isFloat": false

},

"outputFieldValues": [

{

"fieldId": "calc@adjusted-price",

"value": {

"type": "number",

"value": "100.965"

}

}

],

"scenarios": [

{

"pipelineRecordId": "1",

"id": "1",

"pricingProfileId": null,

"name": "Initial Inputs",

"createdAt": "2023-10-12T18:23:06.843820Z",

"preferred": true,

"creditApplicationFieldValues": [

{

"fieldId": "field@occupancy-type",

"value": {

"type": "enum",

"enumTypeId": "occupancy-type",

"variantId": "primary-residence"

}

},

{

"fieldId": "field@purchase-price",

"value": {

"type": "number",

"value": "800000.00"

}

}

],

"selectedProductId": "2120",

"selectedPriceScenarioInfo": {

"type": "rate-with-lock-period",

"selectedInterestRate": "2.5",

"selectedLockPeriod": {

"count": "30",

"unit": "days"

}

},

"isFloat": false

}

],

"encompassOverrides": []

},

"lockLedgerEntries": [

{

"pipelineRecordId": "1",

"id": "1",

"createdAt": "2025-08-29T18:35:23.107931Z",

"createdBy": "1",

"autoConfirmed": false,

"state": {

"lockStatus": {

"kind": "requested",

"lockedFields": {

"product_code": "ARCWCONFF30FNM",

"request_date": "2025-08-29",

"expiration_date": "2025-09-28",

"lock_period": {

"count": "30",

"unit": "days"

},

"effective_lock_ledger_entry_id": "1"

},

"statusIfDenied": {

"kind": "unlocked"

}

},

"lastActionTaken": "submit-lock-request",

"lastLockDeniedDate": null,

"lastExpirationDate": null,

"actionHistory": [

{

"createdAt": "2025-08-29T18:35:22.467601407Z",

"action": "submit-lock-request"

}

]

},

"kind": "submit-lock-request",

"inputs": {

"publishedVersionNumber": "1",

"pricingProfileId": "2",

"selectedProductId": "2120",

"selectedPriceScenarioInfo": {

"type": "rate-with-lock-period",

"selectedInterestRate": "2.5",

"selectedLockPeriod": {

"count": "30",

"unit": "days"

}

},

"selectedPriceScenarioId": "746b3ffe3c9eeeb699caa62c7f1d6fd2",

"requestDate": "2025-08-29",

"defaultFieldValues": [],

"creditApplicationFieldValues": [

{

"fieldId": "field@occupancy-type",

"value": {

"type": "enum",

"enumTypeId": "occupancy-type",

"variantId": "primary-residence"

}

},

{

"fieldId": "field@purchase-price",

"value": {

"type": "number",

"value": "800000.00"

}

}

],

"bypassWorstCase": false

},

"outputs": {

"productId": "2120",

"productName": "30 Year Fixed Rate FNMA Conventional",

"productCode": "ARCWCONFF30FNM",

"investorName": "ARC Home - Wholesale",

"investorCode": "ARCW",

"isPricingEnabled": true,

"productFields": [

{

"fieldId": "field@product-channel",

"value": {

"type": "enum",

"enumTypeId": "channel",

"variantId": "wholesale"

}

},

{

"fieldId": "field@mortgage-type",

"value": {

"type": "enum",

"enumTypeId": "mortgage-type",

"variantId": "conventional"

}

}

],

"productCalculatedFields": [

{

"fieldId": "calc@loan-term-allowed",

"value": {

"type": "enum",

"enumTypeId": "yes-no",

"variantId": "yes"

}

},

{

"fieldId": "calc@amortization-type-allowed",

"value": {

"type": "enum",

"enumTypeId": "yes-no",

"variantId": "yes"

}

}

],

"rateSheetEffectiveTimestamp": "2020-10-19T15:38:00Z",

"priceScenarioFields": [

{

"fieldId": "base-interest-rate",

"value": {

"type": "number",

"value": "2.5"

}

},

{

"fieldId": "rate-lock-period",

"value": {

"type": "duration",

"count": "30",

"unit": "days"

}

},

{

"fieldId": "base-price",

"value": {

"type": "number",

"value": "100.935"

}

}

],

"priceScenarioCalculatedFields": [

{

"fieldId": "calc@ah-va-purch-state-tier",

"value": {

"type": "number",

"value": "0"

}

},

{

"fieldId": "calc@fnma-high-ltv-cap",

"value": {

"type": "number",

"value": "-10.000"

}

}

],

"adjustedRate": "2.5",

"adjustedPrice": "100.965",

"adjustedRateLockPeriod": {

"count": "30",

"unit": "days"

},

"status": "approved",

"reviewRequirements": [],

"priceAdjustments": [

{

"ruleId": "1750",

"amount": "0.03",

"description": "LLPA - ARC Wholesale FNMA/FHLMC Conventional & HomeReady/Home Possible Adjustment"

}

],

"marginAdjustments": [],

"rateAdjustments": [],

"finalPriceAdjustments": [],

"finalRateAdjustments": [],

"finalMarginAdjustments": [],

"stipulations": [

{

"ruleId": "2063",

"text": "..."

}

],

"publishedVersionNumber": "1",

"startingAdjustedRate": null,

"startingAdjustedPrice": null,

"undiscountedRate": "2.5"

}

}

]

}

log-in-error

Sent after a failed log in attempt using the log-in message.

Fields

error: An error message.

Example

{

"message": "log-in-error",

"error": "Invalid credentials"

}

logged-in

Sent after succesfully logging in with a log-in message.

Fields

None

Example

{ "message": "logged-in" }

pipeline-record-created

Sent after succesfully creating a pipeline record using the create-pipeline-record message. Returns the ID of the newly created record.

Fields

pipelineRecordId: The ID of the created pipeline record.

Example

iframe.contentWindow.postMessage(

{

message: "pipeilne-record-created",

pipelineRecordId: "51",

},

loanpassOrigin

);

pipeline-record-creation-error

Sent after a failed attempt to create a pipeline record.

Fields

error: An error message.

Example

{

"message": "pipeline-record-creation-error",

"error": "Failed to create pipeline. Please contact your system administrator for assistance."

}

price-lock

Sent when a user clicks the "Lock Request" button in the UI after the enable-price-locking message is sent.

Fields

role: Contains details about the user's active role.id: The role ID.nameThe display name of the role.

pricingProfile: Contains details about the user's active pricing profile.id: The pricing profile ID.nameThe display name of the pricing profile.

product: Contains details about the product that was price locked.id: The product ID.nameThe display name of the product.

investor: Contains details about the investor of the product that was price locked.id: The investor's ID.name: The display name of the investor.

scenario: The details about the price scenario that was locked. The schema matches the.priceScenarios[]schema returned from the/execute-productPublic API endpoint.status: The status of the price scenario, such asapproved,rejected, etc.adjustedRate: The rate with rate adjustments applied.adjustedPriceThe price with price adjustments applied.priceScenarioFields: An array of price scenario fields and values.fieldId: The field ID.value: An object describing the value of the field, ornullif the field has no value.

calculatedFields: An array of calculated fields and their values for this price scenario.fieldId: The calculated field ID.value: An object describing the value of the field, ornullif the field has no value.

creditApplicationFields: An array of fields and their values that were filled in by the user for the price scenario. This corresponds to thecreditApplicationFieldsfield for the/execute-productPublic API endpoint.fieldId: The input's field ID.value: An object describing the value of the field.

Example

{

"message": "price-lock",

"role": {

"id": "11",

"name": "Loan Officer"

},

"pricingProfile": {

"id": "22",

"name": "Standard"

},

"investor": {

"id": "123",

"name": "Test Investor",

"code": "TI",

"isPricingEnabled": true

},

"product": {

"id": "1234",

"code": "EXAMPLE",

"name": "Example Product",

"description": "Example product",

"activationTimestamp": "2021-01-01T00:00:00Z",

"deactivationTimestamp": null,

"investorId": "123"

},

"scenario": {

"id": "00000000-0000-0000-0000-000000000000",

"priceScenarioFields": [

{

"fieldId": "base-interest-rate",

"value": {

"type": "number",

"value": "1.0"

}

},

{

"fieldId": "rate-lock-period",

"value": {

"type": "duration",

"count": "15",

"unit": "days"

}

},

{

"fieldId": "base-price",

"value": {

"type": "number",

"value": "101.000"

}

}

],

"calculatedFields": [

{

"fieldId": "calc@fsb-lpmi-refinance",

"value": {

"type": "number",

"value": "0.000"

}

},

{

"fieldId": "calc@fsb-jumbo-max-price",

"value": null

},

{

"fieldId": "calc-field@ah-va-purch-tier",

"value": {

"type": "number",

"value": "4"

}

}

],

"adjustedRate": "1.75",

"adjustedRateLockPeriod": {

"count": "15",

"unit": "days"

},

"adjustedPrice": "101.000",

"status": "approved",

"priceAdjustments": [

{

"ruleId": "1234",

"amount": "0.25",

"description": "Price adjustment 1"

},

{

"ruleId": "5678",

"amount": "0.25",

"description": "Price adjustment 2"

}

],

"marginAdjustments": [

{

"ruleId": "12345",

"amount": "-0.300",

"description": "Margin adjustment"

}

],

"rateAdjustments": [],

"stipulations": []

},

"creditApplicationFields": [

{

"fieldId": "field@occupancy-type",

"value": {

"type": "enum",

"enumTypeId": "occupancy-type",

"variantId": "primary-residence"

}

},

{

"fieldId": "field@loan-purpose",

"value": {

"type": "enum",

"enumTypeId": "loan-purpose",

"variantId": "purchase"

}

},

{

"fieldId": "field@decision-credit-score",

"value": {

"type": "number",

"value": "750"

}

},

{

"fieldId": "field@state",

"value": {

"type": "string",

"format": "us-state-code",

"value": "TX"

}

},

{

"fieldId": "field@property-type",

"value": {

"type": "enum",

"enumTypeId": "property-type",

"variantId": "single-family"

}

},

{

"fieldId": "field@base-loan-amount",

"value": {

"type": "number",

"value": "400000.00"

}

}

]

}

price-locking-enabled

Confirmation that price locking has been enabled after sending enable-price-locking.

Fields

None

Example

{ "message": "price-locking-enabled" }

set-fields-error

Sent if set-fields contained invalid or unusable data.

Fields

error: An error message.

Example

{

"message": "set-fields-error",

"error": "There was an error setting fields."

}

set-fields-success

Confirmation that the fields provided in set-fields were applied.

Fields

None

Example

{ "message": "set-fields-success" }

set-pipeline-record-id-error

Sent if the requested pipeline record could not be loaded.

Fields

error: An error message.

Example

{

"message": "set-pipeline-record-id-error",

"error": "Failed to set pipeline record."

}

set-pipeline-record-id-success

Confirmation that the record requested by set-pipeline-record-id was loaded.

Fields

None

Example

{ "message": "set-pipeline-record-id-success" }

set-version-error

Sent if set-version failed.

Fields

error: An error message.

Example

{

"message": "set-version-error",

"error": "Failed to set version (invalid version). Please contact your system administrator for assistance."

}

set-version-success

Confirmation that the version provided in set-version was recorded.

Fields

None

Example

{ "message": "set-version-success" }